Understanding the Texas Health Insurance Subsidy and Tax Credit

50% of people who self-enroll have errors that may mean money is left on the table.

AUSTIN, TX, July 29, 2024 /24-7PressRelease - Understanding the Texas Health Insurance Subsidy and Tax Credit

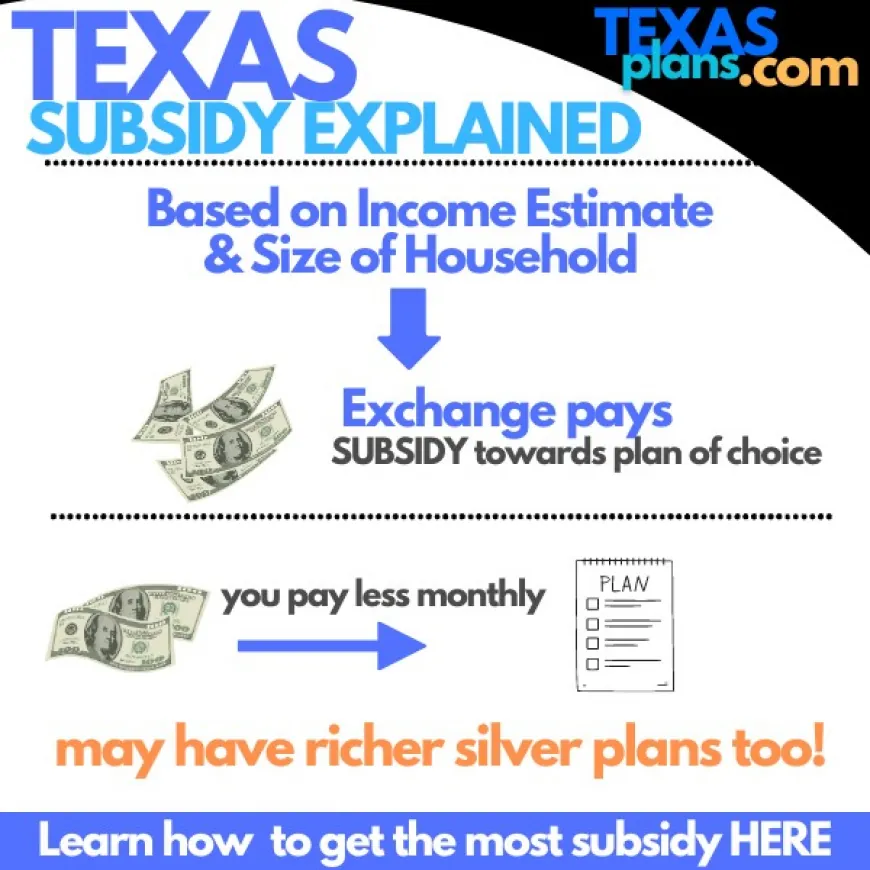

Texas residents now have a clearer path to affordable health insurance thanks to the Exchange that provides subsidies and tax credits. This program is designed to help alleviate the burden of health insurance costs by offering substantial financial support.

Simplifying Health Insurance Costs

Navigating health insurance can be confusing, especially when trying to maximize subsidies and tax credits. To address this, Texas has introduced a program that helps residents reduce their health insurance premiums.

Enrollment on the Texas Exchange has jumped by over 40% year on year as a result of these subsidies.

Read the full article on Texas health insurance subsidies to understand how this free help works and how it can benefit you.

Key Information

Detailed Explanation: Learn how the subsidy and tax credit work together to lower your insurance costs.

Eligibility Requirements: Find out if you qualify for these benefits and understand the criteria.

Application Process: Follow a step-by-step guide to ensure you apply correctly and maximize your benefits.

Importance of the Program

Health insurance is a critical need, and with the rising costs, this program provides significant relief. By taking advantage of the Texas health insurance subsidy and tax credit, residents can ensure they have access to essential medical care without facing overwhelming financial pressure.

Explore the detailed information and find out how to start benefiting from this program today.

Practical Steps and Examples

The article provides a practical breakdown of how the subsidy is applied. For example, if a Silver plan costs $400 and you receive a $250 tax credit, your monthly premium would be just $150. This example illustrates how substantial the savings can be. Some Texans see monthly premiums of zero!

Key Areas Covered

Income and Subsidies: Understand what income counts towards the subsidy and how to estimate it accurately.

Household Definition: Learn how your household composition affects your eligibility and subsidy amount.

Quoting and Applying: Find out how to quote Texas exchange plans with the subsidy included and the importance of accurate information to avoid potential repayment at tax time.

Avoiding Common Pitfalls

A significant portion of applicants make errors that affect their subsidies. This articles emphasizes the importance of entering accurate information to avoid costly mistakes, such as having to repay subsidies at tax time.

How the Subsidy Settles Out at Tax Time

The subsidy is based on your estimated income for the year. If your actual income differs, the subsidy will adjust accordingly. The article explains how to manage these adjustments to avoid surprises at tax time.

Read the full article for comprehensive insights and begin your journey towards more affordable health care today.

Contact:

800-320-6269 or pick a time to chat here.

help@texasplans.com

TexasPlans.com

Learn how to get the most out of the Texas Obamacare subsidy

Texas Plans is dedicated to helping Texans navigate the complexities of health insurance. We provide clear, concise information to ensure you make the best choices for your health coverage needs.